What does SolarWorks! do?

SolarWorks! started in 2009 selling small solar products from Johannesburg via local distributors in southern Africa. The company has since then morphed into a leading pay-as-you-go (PAYGo) provider of solar home systems (SHS) in Mozambique and Malawi.

How did EEP support SolarWorks! ?

In 2016, when they received the grant from EEP, SolarWorks! had already been active in the off-grid sector for several years through cash sales of pico solar products. Competition of Chinese importations, lack of control over the pricing and sales and issues with the local regulator led the company to seek an alternative model. The EEP grant helped SolarWorks! trial the PAYGo business model in Mozambique.

More recently SolarWorks! has been awarded a second grant from EEP to expand into Malawi and replicate their Mozambican success.

We’d been studying PAYGo for about a year. We were a bit scared it would be a flavour of the week kind of thing. `{`…`}` To be really honest, EEP made it possible to start because it’s a capital-intensive business model. We could not have done what we did in year one without EEP. It was a really important grant.

How did the intervention affect SolarWorks! ?

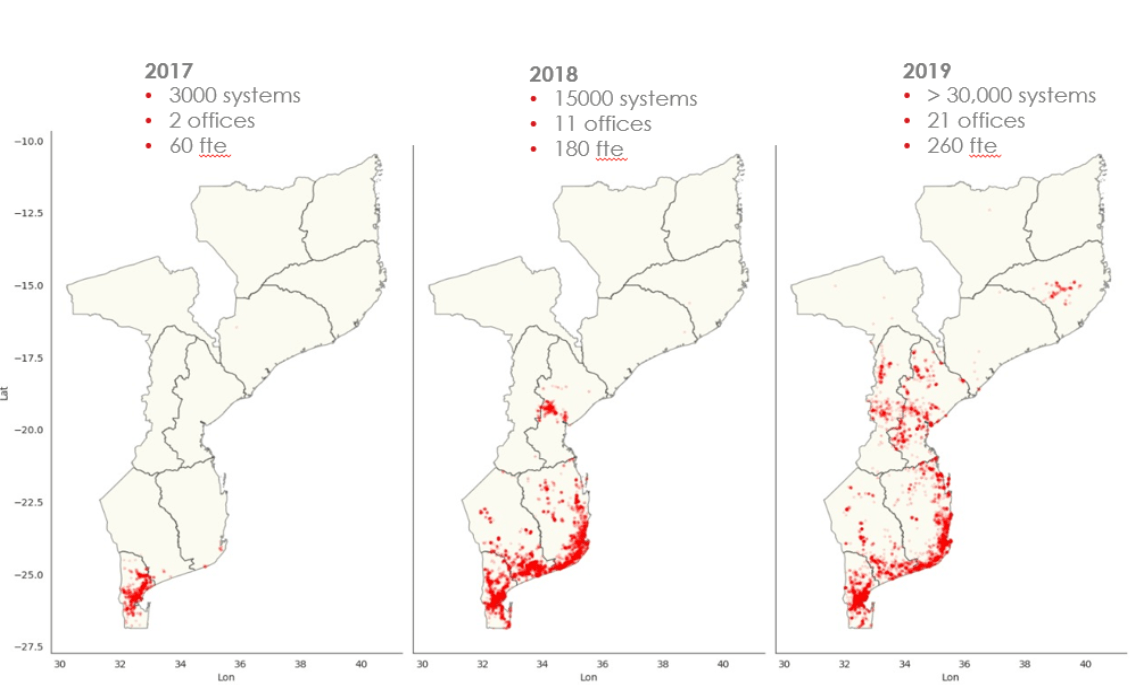

The project enabled SolarWorks! to successfully pivot and prove they could become a PAYGo provider in Mozambique. They have been successfully growing since – the success of the EEP project also allowed SolarWorks! to attract new capital

By 2017, we had reached 3,000 systems sold with an average contract value of $325. Now we are at 40,000. We had 100 people working for us then, now close to 300 with the expansion into Malawi and another additional 300 commission-based workers.

In 2017, we were able to attract debt from a crowdfunding platform. In 2018 EDP came in as a strategic investor - in it for the long run. We could not have reached the size needed to attract them without the EEP grant. We now have more than 15 million in debt facilities’.

Marketing for the clean energy transition

Profile of Precious Vuma, Business Development and Marketing Manager at Powerlive ...

Using innovation to provide access to clean energy

Profile of Felix Boldt, Founder and CEO of Solarworx - Zambia...

Building a Start-up at the Nexus of Energy and Food

Profile of Admore Chiumia, Founder of Green Impact Technologies - Malawi...