The final session of EEP Africa Knowledge Week 2021 focused on financing opportunities to enable early-stage companies to Grow Beyond Grant Funding.

This virtual event on 25 November featured a sneak-peek at results from a forthcoming EEP Africa study on how grant funding can help build sustainable companies, followed by a discussion between international investors, Charm Impact and Lion’s Head Global Partners, and local clean energy companies, Ensol Tanzania and Powerlive Zimbabwe.

Flexible early-stage financing is vital for clean energy companies in emerging markets. Grant funding plays a critical role in supporting start-ups and local companies, enabling them to test new technologies and business models in challenging operating environments. In order to achieve scale and become sustainable, however, a company must secure follow-on financing from commercial investors. In this session, the speakers looked at how different stakeholders define success and what challenges early-stage companies face when developing their business beyond grants and becoming investment-ready.

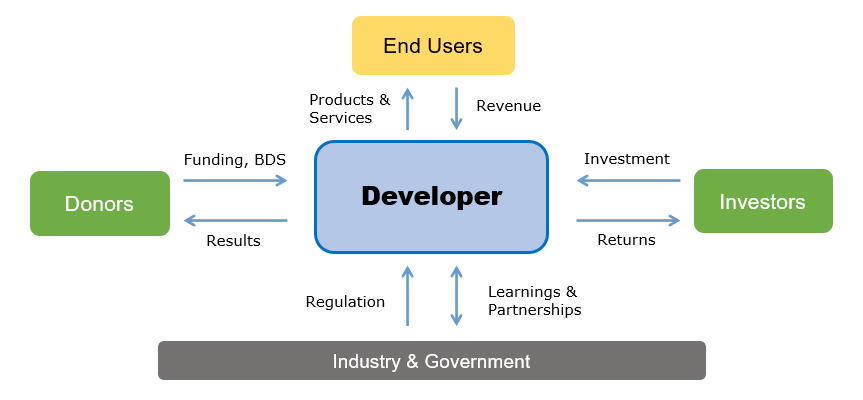

Chris Browne, M&E Advisor for EEP Africa, presented key findings from research into how grants can be used in the best way to make companies successful in the long run. Based on a portfolio analysis and series of focus groups during the past year, it is clear that all companies use grant funding primarily for testing – learning money to find the right fit between product, model and market – and initial scaling. But different stakeholders have different criteria for success. Grant providers need to recognize the interests of all stakeholders, with the Developer at the center, and to build in flexibility so that the company can adapt to market learnings along the way.

Stakeholder Mapping

Grant funding should also be viewed in terms of the longer-term development of the company. In order to truly scale, commercial investment is required. Thus, a key element of success is advancing company maturity and investment readiness. Our research has shown that investors are mainly looking at two things: the model/product and the team. Strength in both areas is needed and data collection is critical; companies need well-documented evidence to secure follow-on financing. Local and women-led companies also need additional support to develop their business case and connect with investors.

The panel discussion affirmed these findings and the value of grant funding for early-stage projects by private sector companies in the clean energy sector. The panellists included small-ticket and large-ticket investors, as well as local companies in both the start-up and scale-up stage of development.

Each speaker shared their own perspective on how to grow a company beyond grant funding. The full session can be viewed in the recording, the presentation can be downloaded here, and highlights from each panellist’s remarks are included below.

Sharon Yeti, co-founder and CEO of Powerlive Zimbabwe, emphasised the role of grant funding in de-risking the business and achieving proof of concept. “The grant has accelerated the growth of the company and helped us reach a stage that would have normally taken us much longer. This is a good thing because most investors are not keen to invest in start-ups until they reach a certain threshold.” However, there is still a shortage of working capital for local companies and more patient capital is needed.

Bethany Larsen, co-Founder and Chief Investment Officer at Charm Impact, a provider of early-stage debt finance, notes that “grants help companies prove their business model and market.” For Charm Impact to invest, it comes down to three main things: cash flow (a handle on basic unit economics, operating expenses and profit margins); the company’s team and experience; and customer selection and management, including ensuring product quality. One of the biggest skills gap in the sector is financial modelling, but the biggest challenge overall is connecting the dots to help investors source local companies.

Prosper Magali, a Director and Founder of ENSOL Tanzania, emphasised the challenge of locally-owned companies to raise investment. He also stressed that “even mature companies need grant funding to pilot or test a new idea or business model, or to enter a new market that might be quite risky. Also, we must admit that most off-grid companies are operating in scenarios where the target customers are poor and can barely afford the services being offered to them. That is the biggest challenge.” To deal with this, there is a need for more concessional financing, new financing tools from local financial institutions, mechanisms to deal with forex fluctuations, and consumer financing.

Alex Kanyonga, Director at Lion’s Head Global Partners (LHGP), which manages the Off-Grid Energy Access Fund (OGEF), noted that investors with larger ticket sizes have more stringent requirements. A company must demonstrate strong credit function, company track record and capitalisation, backed up by data management and performance against standard industry metrics, and a strong team with local presence. Pipeline development efforts, such as those hosted by EEP Africa or the Household Solar Funders Group (HSFG), are critical to connect companies and investors.

This session was moderated by EEP Africa Head of Portfolio and Finance Lauri Tuomaala.

At the end of the panel, the winners of EEP Africa Project of the Year 2021 were announced: Powerlive won for best Start Up and Jaza Energy won for best Scale Up.

EEP Africa Knowledge Week is an annual series of events that examine evolving themes and innovative projects in the clean energy sector in Africa. The event in 2021 included sessions on financing, leadership, and the agriculture-energy nexus, including cold chain and agro-processing.